The Paycheck Reality Check: Preparing Beauty Students for What They'll Actually Take Home

Blog > The Paycheck Reality Check: Preparing Beauty Students for What They'll Actually Take Home

Picture this: Your star student just landed their first salon position at $15/hour. They're calculating their expected income—40 hours a week times $15 equals $600 weekly, or about $2,400 monthly. They've already planned their apartment budget, car payment, and spending money around this figure.

Then reality hits. Their first paycheck shows $960 for two weeks of work instead of the expected $1,200. They're confused, frustrated, and unprepared for the 20-25% reduction from gross to net pay.

This scenario plays out repeatedly with beauty school graduates who enter the workforce without understanding the difference between gross pay and net pay — a gap that directly impacts their financial stability and career satisfaction.

The Great Paycheck Mystery:

Why Students Are Caught Off Guard

Many beauty students focus intensively on technical skills while remaining largely unaware of paycheck mechanics. According to research, 45% of Americans don't understand how much tax they pay, and this knowledge gap is particularly problematic for new beauty professionals who may experience:

Variable income structures: Commission-based pay, tip income, and seasonal fluctuations

Different employment classifications: Employee vs. independent contractor tax implications

Benefit deductions: Health insurance, retirement contributions, and other voluntary deductions

Multiple tax jurisdictions: Federal, state, and sometimes local tax obligations

Without this knowledge, graduates make financial commitments based on gross income figures that don't reflect their actual spending power.

Breaking Down the Paycheck:

What Students Need to Know

Gross Earnings vs. Net Pay Help students understand that gross earnings represent their total compensation before any deductions. This includes hourly wages, commission, tips, and bonuses. However, net pay — what actually hits their bank account — can be 20-40% less after:

Federal income taxes

State income taxes (where applicable)

FICA taxes (Social Security and Medicare)

Benefit deductions

Other voluntary withholdings

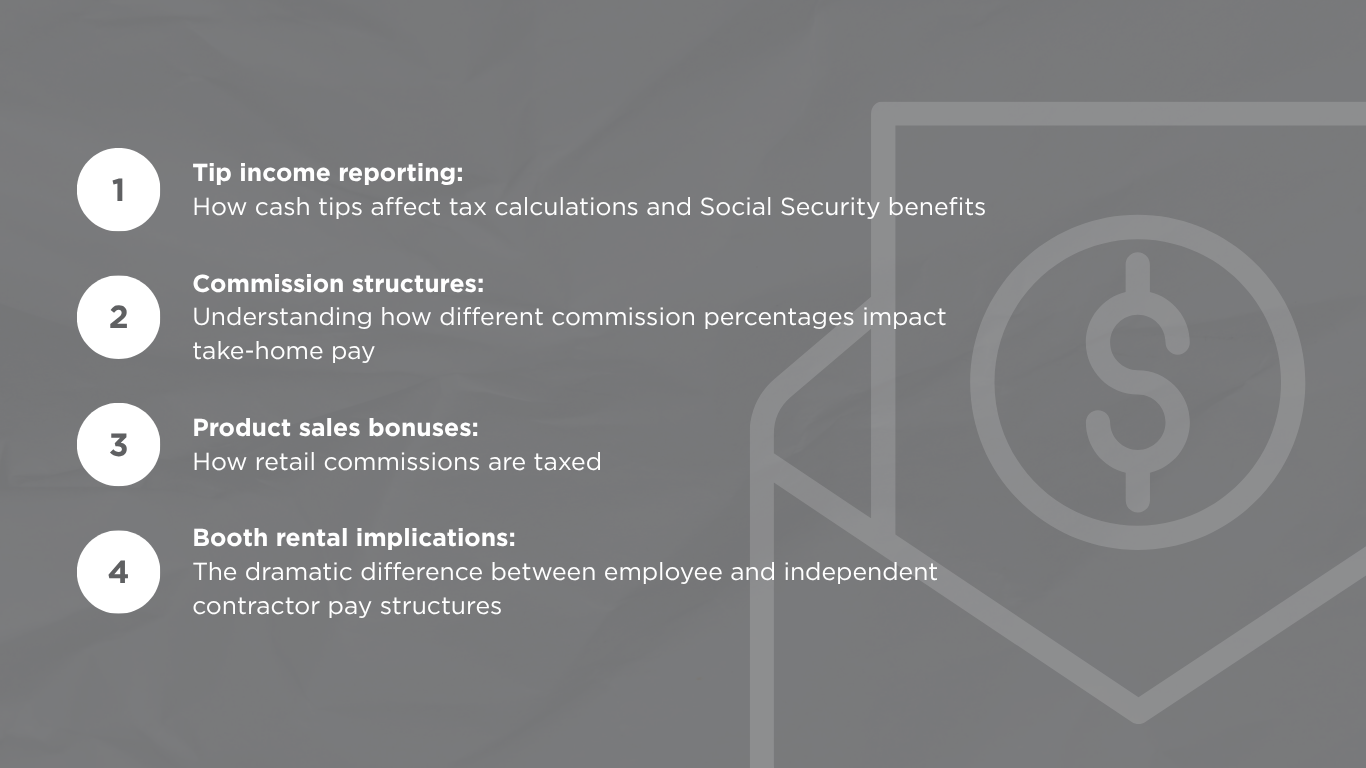

Industry-Specific Considerations Beauty professionals face unique paycheck complexities:

The Self-Employment Tax Surprise

Many beauty school graduates aspire to booth rental or independent contractor status without understanding the tax implications. While employees split FICA taxes with their employer (7.65% each), independent contractors pay both portions — 15.3% total — through self-employment taxes.

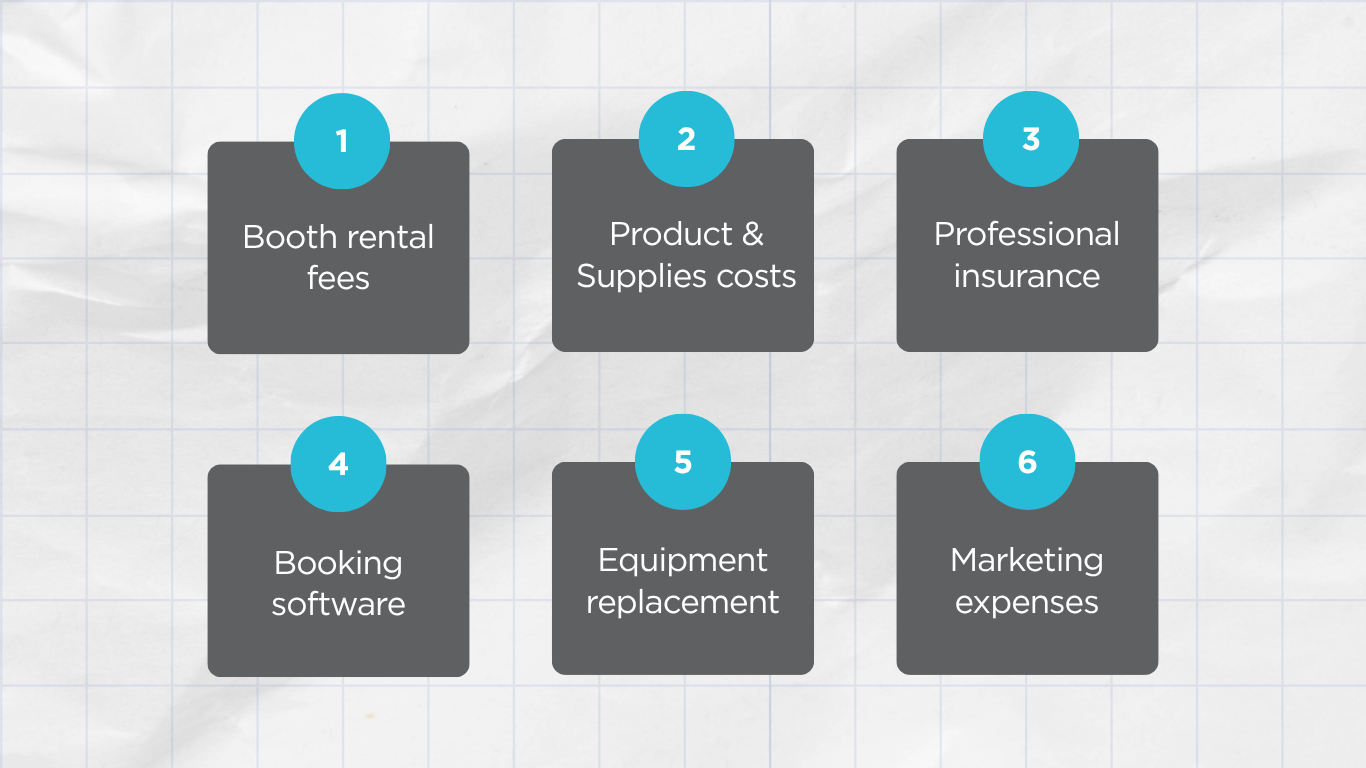

This means a booth renter earning the same gross income as an employee takes home significantly less money, even before considering additional expenses like:

Creating Paycheck Literacy in Your Curriculum

Use Real-World Examples Create sample pay stubs showing different scenarios:

Entry-level salon employee

Experienced stylist with commission

Booth renter/independent contractor

Salon owner with employee responsibilities

Address the Emotional Component Acknowledge that seeing the gap between gross and net pay can be discouraging. Help students understand:

What their tax contributions fund (Social Security, Medicare, infrastructure)

How proper tax planning can minimize surprises

Why understanding paycheck mechanics empowers better financial decisions

Connect to Career Planning Show students how paycheck knowledge influences major life decisions:

Apartment affordability calculations

Car payment budgeting

Emergency fund planning

Career advancement timing

Beyond the Basics:

Teaching Paycheck Optimization

Help students understand they have some control over their take-home pay through:

W-4 Form Management Teach students to properly complete their W-4 forms and adjust them as life circumstances change. Many new graduates either under-withhold (creating tax debt) or over-withhold (providing interest-free loans to the government).

Benefit Strategy Help students understand how pre-tax benefits like health insurance premiums, retirement contributions, and flexible spending accounts can actually increase their spending power by reducing taxable income.

Professional Development Planning Show students how investing in continuing education or professional certifications—often tax-deductible—can increase their earning capacity while potentially reducing their tax burden.

Implementation Strategies

Consider these approaches for integrating paycheck education:

Partner with local salons to provide real pay stub examples (with permission)

Create side-by-side comparisons of different beauty career paths

Invite recent graduates to share their paycheck transition experiences

Develop simple worksheets for calculating realistic post-graduation budgets

The beauty industry offers tremendous earning potential, but only when professionals understand the complete financial picture. By preparing students for paycheck realities, we set them up for both immediate success and long-term financial stability.